The Nisso Group (the “Group”) is promoting respect for human rights and the creation of compassionate human relationships based on (its founding philosophy) "Nurturing and Bringing Out the Best in People". With the aim of creating new corporate value that can contribute to society by striving to create and establish its own unique, proprietary technologies, the Group shall ensure the transparency of management by complying with laws and ordinances and disclosing accurate information. The Group recognizes the importance of corporate governance in order to achieve continuous improvement of corporate value, and conducts management focused on compliance. Furthermore, the Group respects the rights of shareholders, and aims to be an enterprise that is trusted by society.

Corporate governance

Basic Views

Compliance with the Corporate Governance Code

[Reasons for Non-compliance with the Principles of the Corporate Governance Code]

The Company has implemented all of the principles of the Corporate Governance Code (revised on June 11, 2021).

[Disclosure Based on the Principles of the Corporate Governance Code]

[Principle 1.4 Cross-Shareholdings]

In principle, the Company shall not hold cross-shareholdings.

However, for the purpose of increasing corporate value over the medium- to long-term, it is the Company's policy to hold shares when strategic significance and rationality of holding such shares are recognized.

Regarding the exercise of voting rights pertaining to cross-shareholdings, the Company shall determine to vote for or against each proposal from the viewpoint of whether or not it will contribute to the enhancement of the corporate value of the Group and issuing companies. The proposals considered to be particularly important are as follows:

① Appropriation of Surplus ② Election of Corporate Officers ③ Organizational Restructuring ④ Takeover Defense Measure Proposal etc.

In addition, if the significance and rationality of holding such shares decreases, the Company shall sell those shares after taking into consideration their impact on the market.

[Principle 1.7 Related Party Transactions]

The Company does not conduct related party transactions in principle, but in cases where they are carried out, in order to ensure that related party transactions do not harm the interests of the Company and the common interests of its shareholders, in accordance with laws and ordinances, the "Regulations of the Board of Directors", and the "Related Party Transaction Management Regulations", and with the consent of the Audit and Supervisory Committee, the Company shall obtain approval from the Board of Directors. Furthermore, the Company periodically investigates the status of the transactions on a yearly basis, in addition to reporting and receiving approval for such transactions at the first Board of Directors' Meeting held at the beginning of each fiscal year.

[Supplementary Principle 2.4.1 Ensuring Diversity in Appointment of Core Human Resources]

Japanese:https://www.nisso-hd.com/sustainability/social/human-resources/

English:https://www.nisso-hd.com/en/sustainability/social/human-resources/ Internal Environment Development Policy

Japanese:https://www.nisso-hd.com/sustainability/social/diversity/

English:https://www.nisso-hd.com/en/sustainability/social/diversity/

[Principle 2.6 Roles of Corporate Pension Funds as Asset Owners]

With regard to the management of reserved funds of the defined benefit corporate pension to which NISSO CORPORATION, a consolidated subsidiary of the Company belongs, the Company has established pension regulations/basic management policies, etc., receives periodic operational status reports from life insurance companies and trust banks, which are entrusted management institutions, and administers the appropriate operation/management of corporate pensions.

With regard to making important decisions such as the reexamination of policy asset proportions, the qualitative evaluation of management institutions, and the changes to each policy, the Personnel Division, which is the division in charge of operations, after consulting with the Finance & Accounting Division, shall formulate the necessary drafts, and after receiving advisories from the Asset Management Committee, which consists of the person in charge of the relevant personnel and finance departments and the officer in charge of the relevant finance department, such decisions shall be made at the Board of Directors' Meetings. The Company discloses the management results of reserved funds to its employees.

Furthermore, the division in charge of management strives to enhance its expertise through the participation of various seminars.

[Principle 3.1 Full Disclosure]

(i) Management philosophy, management strategy and management plan

Under the founding philosophy of "Nurturing and Bringing Out the Best in People", the Group has formulated its management philosophy and has provided it on its website. In addition, the Medium-term Management Plan has been explained at briefing sessions for investors, and is provided on the its website.

(ii) Basic views and policies on corporate governance

The Company's basic views and policies on corporate governance are as stated in Basic Views.

(iii) Policies and procedures for the determination of senior management executives/Directors remuneration by the Board of Directors

Please refer to "Overview of Corporate Governance Structures".

In addition, in order to ensure fairness, transparency, and objectivity of procedures and to further enhance corporate governance, the remuneration of Directors (excluding Directors who are Audit & Supervisory Committee Members) is determined by resolution of the Board of Directors, after consulting with the Nomination and Remuneration Committee, which is comprised of a majority of Independent External Directors.

(iv) Policies and procedures for the appointment/dismissal of senior management executives and the nomination of Director candidates by the Board of Directors

The nomination of Director candidates (excluding Directors who are Audit & Supervisory Committee Members) is based on the Company's management philosophy and management strategy, taking into account the business content, scale, business environment, etc., and candidates who possess the knowledge, experience and qualifications that can contribute to the fulfillment of the functions of the Board of Directors are selected as candidates at the Board of Directors' Meetings after consulting with the Nomination and Remuneration Committee. In addition, the nomination of candidates for Directors who are Audit & Supervisory Committee Members is based on the selection criteria prescribed in the Auditing Standards of the Audit and Supervisory Committee, and personnel to which the Audit and Supervisory Committee gives consent to are selected as candidates.

Regarding the dismissal of senior management executives, in cases such as where it is deemed that he/she has not been able to sufficiently contribute to the fulfillment of the functions of the Board of Directors, in the same manner as in their appointment, upon consulting with the Nomination and Remuneration Committee, deliberations shall be held at the Board of Directors' Meetings, and such resolutions shall be made at the General Meetings of Shareholders.

(v) Explanations with respect to individual appointments/nominations for the appointment/dismissal of senior management executives and the nomination of Director candidates by the Board of Directors

Regarding the individual appointments/nominations of Director candidates, their brief career summaries and reasons for their selection are provided in the "Notice of the General Meeting of Shareholders".

[Supplementary Principle 3.1.3 Initiatives for Sustainability, etc.]

English:https://www.nisso-hd.com/en/sustainability/

[Supplementary Principle 4.1.1 Roles/Responsibilities of the Board of Directors (1)]

The Board of Directors makes important decisions on management strategies, management plans and other matters concerning the management of the Company, as well as supervising the execution of business in accordance with laws, the Articles of Incorporation, and other regulations of the Company. With respect to other matters, in order to promptly make decisions concerning the execution of business, the authority related to the execution of business is entrusted to the Executive Officers, and Division Heads.

[Principle 4.9 Independence Standards and Qualifications for Independent External Directors]

In selecting Independent External Directors, the Company has formulated its own independence standards, as well as meeting the requirements of External Directors as stipulated in the Companies Act and the independence criteria set by the Tokyo Stock Exchange.

Please refer to the Corporate Governance Report for the "Criteria for Appointment of Independent Officers" established by the Company.

[Supplementary Principle 4.10.1 Appropriate Involvement/Advice of Independent External Directors Through the Establishment of Independent Nomination and Remuneration Committees]

Please refer to the Corporate Governance Report.

[Supplementary Principle 4.11.1 Preconditions for Board of Directors Effectiveness]

The Board of Directors shall maintain the diversity and appropriate number of its members in order to make appropriate decisions in accordance with the Company's business domain/scale. The appointment of Directors is based on the Company's management philosophy and management strategy, with consideration to business contents/scale/business environment, etc., and personnel with knowledge/experience and qualifications that can contribute to the fulfillment of the functions of the Board of Directors are selected.

[Supplementary Principle 4.11.2 Preconditions for Board of Directors Effectiveness]

The Company's Directors select candidates who can secure the time and effort required to appropriately fulfill their roles and responsibilities. In cases where Directors concurrently serve as officers of other listed companies, the number of such positions shall be kept within a reasonable range, and the status of significant concurrent positions of the Company's Directors is scheduled to be provided annually in the "Annual Securities Report" (in Japanese only), the "Notice of the General Meeting of Shareholders" and other documents.

[Supplementary Principle 4.11.3 Preconditions for Board of Directors Effectiveness]

The Company conducted a questionnaire survey of all Directors regarding the effectiveness of the Board of Directors for all Directors in April 2025, and the results were analyzed and evaluated by the Board of Directors.

In FY 3/2025, responses to a total of 42 questions that were asked in a questionnaire survey, including (1) 6 questions on the composition of the Board of Directors, (2) 10 questions on the operation of the Board of Directors, (3) 17 questions on the agenda of the Board of Directors, (4) 8 questions on the system to support the Board of Directors, and (5) 1 question on the overall opinions, and an exchange of opinions on the effectiveness evaluation were conducted in May, and the analysis and evaluation of the effectiveness were reported to the Board of Directors in June 2025. As a result, all of the items have been generally positively evaluated by all Directors, and the Company recognizes that the effectiveness of its Board of Directors has been ensured. However, opinions have been raised both internally and externally that there was room for improvement in the advance distribution of materials, the deliberation process of important proposals, and the review of the criteria for submitting proposals, including the delegation of authority.

Based on these opinions, the Company will formulate a response plan for the issues raised and strive to enhance its effectiveness.

[Supplementary Principle 4.14.2 Director Training]

The Company's Directors shall endeavor to acquire and appropriately update the knowledge deemed necessary to fulfill their roles and responsibilities, for matters such as corporate governance and compliance, and the Company shall provide opportunities for training and support of costs for such purposes. In addition, when an External Director assumes office, the Group shall provide opportunities for them to acquire information about its businesses, business environment, financial condition, organization, etc.

[Principle 5.1 Policy for Constructive Dialogue with Shareholders]

Please refer to the "Policy for Constructive Dialogue with Shareholders" here.

[Measures to Realize Management that is Conscious of Capital Costs and Share Prices]

| Description Content | Disclosure of initiatives (update) |

| Disclosure in English | Yes |

| Date of update | June 26, 2025 |

【Explanation of Applicable Item】

The Company closely monitors its own capital costs (cost of equity and weighted average cost of capital (WACC)) and strives to pursue earning power and improve capital efficiency based on return on equity (ROE) and return on invested capital (ROIC) as key management indicators. In addition, the Company will strive to enhance corporate value by realizing a structure in which ROIC exceeds the cost of capital (weighted average cost of capital (WACC)) in a stable manner.

During the current consolidated fiscal year, ROE, which is a key management indicator, was 12.3% and ROIC was 13.1%, as a result of the execution of strategic investments and the maintenance of a sound financial base. As a result, ROIC exceeded WACC (approximately 8%, the Company estimate based on CAPM).

Furthermore, each indicator is calculated based on the following definitions.

・Return on Equity (ROE):

Profit attributable to owners of parent ÷ ((equity capital at beginning of period + equity capital at end of period) ÷ 2)

・Return on Invested Capital (ROIC):

After-tax operating profit ÷ invested capital (average interest-bearing liabilities for current period +average net assets for current period)

Status of the Corporate Governance Structure

1. Organizational Composition and Operation

Organization Form |

Company with Audit and Supervisory Committee |

[Directors]

| Maximum Number of Directors Stipulated in Articles of Incorporation | 14 |

| Term of Office Stipulated in Articles of Incorporation | 1 year |

| Chairperson of the Board of Directors | President |

| Number of Directors | 9 |

| Status of Appointment of External Directors | Appointed |

| Number of External Directors | 4 |

| Number of External Directors Designated as Independent Officers | 4 |

[Audit and Supervisory Committee]

| All Committee Members | 3 |

| Full-time Members | 1 |

| Internal Directors | 0 |

| External Directors | 3 |

| Chairperson | External Director |

Appointment of Directors and Employees to Assist in Fulfillment of Duties of Audit and Supervisory Committee

Not Appointed

Reasons for Adopting Current System

In the event that the Audit and Supervisory Committee requests that an employee be appointed to assist in its duties, the Company will immediately appoint an employee. Employees who assist in the duties of the Audit and Supervisory Committee shall perform their duties under the direction and orders of the Audit & Supervisory Committee Members, and decisions on personnel matters shall be discussed in advance with the Audit and Supervisory Committee.

Cooperation between Audit and Supervisory Committee, Accounting Auditor, and Internal Auditing Division

In accordance with the audit policy and audit plan established by the Audit and Supervisory Committee, the Audit and Supervisory Committee monitors the implementation status of governance, inspects important approval documents, and conducts on-site inspections of business offices, exchanges opinions and cooperates with the Accounting Auditor and the Internal Auditing Division led by the Full-time Audit & Supervisory Committee Member, and strives to audit the execution of duties by Directors through effective audits.

2. Director Remuneration

(Disclosure of Policy on Determining Remuneration Amounts and Calculation Methods)

■Policy for Determining Director Remuneration, etc.

Basic Policy

The remuneration of Directors (excluding Directors who are Audit & Supervisory Committee Members) of the Company shall be based on a remuneration system linked to shareholder interests so that it can fully function as an incentive to continuously enhance corporate value by achieving short-term business results and realizing the Medium-term Management Plan. In addition, when determining the remuneration of individual Directors, the Company's basic policy shall be to set an appropriate level based on their respective responsibilities.

The remuneration level of Directors shall be determined in consideration of the balance between the Company's management content and employee salaries, etc., based on the business scales of companies similar to that of the Company and the remuneration level benchmarked by companies belonging to related industries and business types.Policy on the Determination of the Amount of Individual Remuneration, etc., for Basic Remuneration (Fixed Remuneration) and the Calculation Method Thereof (Includes policies on the timing or conditions under which remuneration, etc., are to be rewarded.)

The basic remuneration of the Company's Directors shall be determined by taking into account the roles and responsibilities, etc., and a fixed amount shall be paid each month.

In addition, the remuneration for External Directors shall be limited to basic remuneration, taking into account the position in which they assume the supervisory function of management.Policy on the Determination of the Content and Amount or Method of Calculating the Number of Performance-linked Remuneration and Non-monetary Remuneration (Includes policies on the timing or conditions under which remuneration, etc., are to be rewarded.)

Performance-linked remuneration shall be paid at a fixed time each year in an amount calculated in accordance with the target achievement rate, and is done by clarifying the responsibility for achieving short-term performance, setting evaluation indicators to increase motivation to contribute to the achievement indicators to increase the motivation to contribute to the achievement of the Medium-term Management Plan as well as the enhancement of corporate value.

Furthermore, the amount of performance-linked remuneration shall vary in the range of 0% and 150% depending on the achievement rate of the indicator.

a. Indicators related to performance-linked remuneration

(Group performance)

・3-year consolidated net sales growth rate

In order to measure the growth potential of the Company's business activities, the consolidated net sales growth rate shall be used as an indicator.

In addition, in order not to be excessively affected by environmental changes in a single fiscal year,the criteria shall be based on the 3-year average including the current fiscal year.

・Consolidated operating profit (initial target ratio and Medium-term Management Plan target ratio)

In order to measure the profitability of the Company's business activities, consolidated operating profit shall be used as an indicator.

The Company shall measure the achievement level of both its initial targets and the targets of the Medium-term Management Plan.

(Individual performance)

・Individual performance targets

Quantitative and qualitative individual performance targets shall be set for each individual and deliberated by the Nomination and Remuneration Committee.

With regard to the evaluation of target achievement levels, the result of the initial targets shall be deliberated by the Nomination and Remuneration Committee.

b.Calculation method of performance-linked remuneration payment amount

The formula for calculating the amount of performance-linked remuneration by individual is as follows:

Performance-linked remuneration payment amount = standard amount of payment by position x

indicator payment rate*

*Indicator payment rate

The indicator payment rate is calculated by multiplying the achievement level of each indicator by the

evaluation weight.

In order to provide non-monetary remuneration as an incentive to share value with shareholders, to raise awareness of share prices among Directors, and to enhance corporate value over the medium- to long-term, restricted shares with a transfer restriction period (the period from the payment date to the date of resignation or retirement, etc., from the position of Director or any other position determined by the Board of Directors of the Company) shall be granted, and the number of shares to be granted, determined by comprehensively taking into account the title/position, etc., shall be granted at a certain time after the conclusion of the Ordinary General Meeting of Shareholders. Furthermore, such restricted shares shall be managed in a dedicated account opened at a securities company during the transfer restriction period so that they cannot be transferred, have security interests established, or otherwise disposed of during the transfer restriction period.Policy on the Determination of the Ratio of the Amount of Basic Remuneration, Performance-linked Remuneration, etc., or Non-monetary Remuneration, etc., to the Amount of Individual Remuneration, etc., of Directors

Regarding the remuneration ratio by type of Director, the higher the position, the higher the weight of performance-linked remuneration and restricted share remuneration share shall be.

Matters related to Decisions on the Content of Individual Remuneration of Directors

Regarding the amount of remuneration for each individual Director, based on the resolution of the Board of Directors, the Representative Director shall be entrusted with the determination of its specific content. In addition, the content of such authority shall be the amount of basic remuneration and performance-linked remuneration for each Director.

The Board of Directors shall consult with the Nomination and Remuneration Committee on the draft so that such authority can be appropriately exercised by the Representative Director, and the Representative Director who has received the above mandate shall determine the content of the individual remuneration based on the report.

For non-monetary compensation, the Board of Directors shall determine the number of shares to be allocated to each individual Director based on the report of the Nomination and Remuneration Committee.

(Skills that the Board of Directors should Possess)

| Skill items | Reasons for selection as an item |

| Management | Even in a rapidly changing business environment, it is necessary to have the skills to present policies and plans for the sustainable growth of the Group and the enhancement of corporate value over the medium- to long-term. |

| Markets・Business | In addition to being familiar with the human resource services business, including human resources development and education, it is also necessary to have skills to gain insight into market trends and needs in other business areas. |

| Finance・Accounting | It is necessary to have the skills to make decisions on "offensive" and "defensive" investments and fund-raising based on the profitability of the Group. |

| Organization・ Human Resources |

In order to achieve sustainable growth of the Group and the enhancement of corporate value over the medium- to long-term, it is necessary to have the skills to formulate and manage organizational and human resources strategies that enable diverse human resources to maximize their individuality and abilities. |

| Risk Management | Rather than simply reducing risks, it is necessary to have the skills to understand risks and to determine whether or not to appropriately retain risks when necessary for the sustainable growth of the Group and the enhancement of corporate value over the medium- to long-term. |

| Society | In order to continue medium- to long-term sustainable growth and development, it is important to co-exist and co-prosper with stakeholders. so it is necessary to have the skills to understand different cultures and diverse values, and to plan and implement initiatives to fulfill social responsibilities. |

| Internal Control・Governance | It is necessary to have the skills to legally and appropriately construct and promote the business processes of the Group and to manage sound corporate governance. |

(Skills Matrix of Directors)

Based on the Group's medium- to long-term direction and business strategy, the Company defines the skills it deems necessary for the Board of Directors at the present time as "Management", "Markets・Business", "Finance・Accounting", "Organization・Human Resources", "Risk Management", "Society", and "Internal Control・Governance".

The above skills will be reviewed as appropriate, taking into account the external environment and the status of the Group.

| Name | Position | Management | Markets Business |

Finance Accounting |

Organization Human Resources |

Risk Management | Society | Internal Control Governance |

| Ryuichi Shimizu | Representative Director, President & Executive Officer | ● |

● |

● |

● |

|||

| Kenji Fujino | Director & Executive Officer | ● |

● |

● |

● |

|||

| Yoichiro Tanaka | Director & Executive Officer | ● |

● |

● |

● |

|||

| Kenichi Nomura | Director & Executive Officer | ● |

● |

● |

● |

|||

| Takashi Endo | Director & Executive Officer | ● |

● |

● |

● |

|||

| Junichi Fukui | External Director | ● |

● |

● |

● |

|||

| Yukiteru Hamada | External Director (Full-time Audit & Supervisory Committee Member) |

● |

● |

● |

● |

|||

| Miki Ohno | External Director (Audit & Supervisory Committee Member) |

● |

● |

● |

||||

| Hideo Sakano | External Director (Audit & Supervisory Committee Member) |

● |

● |

*The above table does not represent all the knowledge and experience of the Directors.

*Of the skills possessed by each Director, up to four skills that can be particularly contributed are marked with "●".

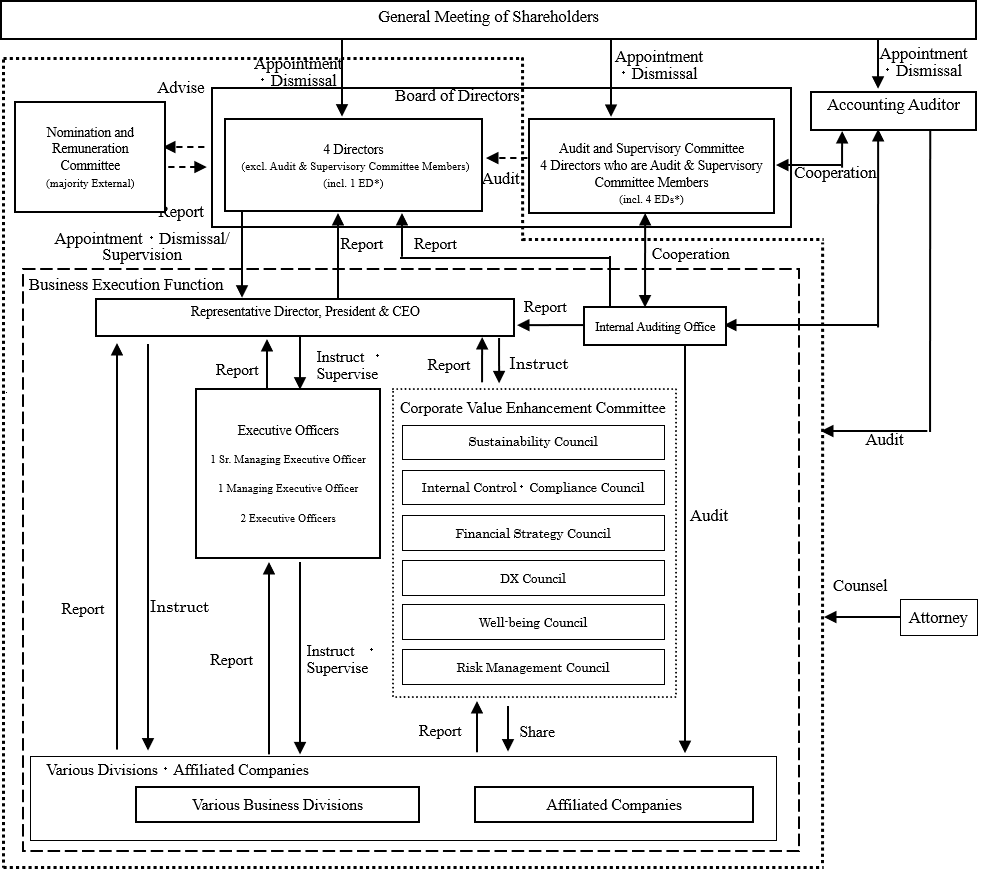

Overview of Corporate Governance Structure

【Corporate Government Structure】

(Matters on Functions of Business Execution, Auditing, Oversight, Nomination and Remuneration Decisions)

a. Board of Directors

The Company's Board of Directors is comprised of 9 Directors (including 4 External Directors). In addition to holding regular Board of Directors' Meetings once a month, in principle, a system has been established where extraordinary meetings can be flexibly held when important matters arise. As a supervisory body for decision-making and business execution of important matters concerning the management of the Company, the Board of Directors examines the validity, efficiency and fairness of management, and resolves matters that are stipulated by laws and ordinances as well as other matters related to important business tasks.

b. Audit and Supervisory Committee

The Audit and Supervisory Committee is comprised of 3 Directors who are Audit & Supervisory Committee Members (including 3 External Directors). Audit policies and audit plans are discussed and decided by the Audit and Supervisory Committee.

In addition to striving to communicate with Directors and employees who are not Audit & Supervisory Committee Members to gather information, Directors who are Audit & Supervisory Committee Members attend Board of Directors' meetings, receive reports on the status of the execution of duties from Directors and employees, request explanations as deemed necessary, inspect important decision-making documents etc., and investigate the status of the Company's business operations and assets.

The Audit and Supervisory Committee convenes on a regular basis once a month, and extraordinary meetings are held occasionally as deemed necessary.

Furthermore, the Audit and Supervisory Committee works closely with the Internal Auditing Office and the Accounting Auditor, and strives to enhance the effectiveness and efficiency of audits.

c. Nomination and Remuneration Committee

The Nomination and Remuneration Committee is comprised of 3 Independent External Directors and the Representative Director, President & Executive Officer, and is chaired by an Independent External Director.

For the purpose of enhancing the transparency of personnel affairs and remuneration, etc., of Directors (excluding Directors who are Audit & Supervisory Committee Members) and Executive Officers, it will report to the Board of Directors matters concerning (i) the personnel affairs of Representative Directors, Directors, Executive Officers and Directors of subsidiaries, as well as successor planning, and (ii) the remuneration structure and remuneration levels of Directors and Executive Officers based on the evaluation of the company's business performance, etc.

The Nomination and Remuneration Committee will be convened at any time as deemed necessary.

d. Sustainability Committee and Risk Management Committee

The Sustainability Committee and the Risk Management Committee have been established with the aim to enhance the Group's corporate value over the medium- to long- term, and are comprised of the President & Executive Officer, Executive Officers, representatives of subsidiaries, and Audit & Supervisory Committee Members.

The Sustainability Committee conducts activities to improve sustainability issues, including social responsibility, as well as education and awareness-raising. In addition, the Risk Management Committee discusses issues related to significant management risks, compliance issues, and matters related to internal control issues and the direction of resolutions.

e. Internal Audits and Audit and Supervisory Committee Audits

The Internal Auditing Division, which is under the direct control of the Representative Director & President, is in charge of internal audits, and has staff members in addition to the Division Head. Based on the fiscal year plan, the Internal Auditing Division conducts audits for all departments and divisions of Headquarters, Sales Offices and affiliated companies, prepares audit reports, and reports the results to the Board of Directors and the Representative Director & President. In addition, instructions for improvements based on the results of the audits are issued to the department/division that has received the audits, and the status of improvements are reported by them and confirmed by the Internal Auditing Division without delay. Moreover, follow-up audits and special audits are conducted as deemed necessary.

Audit and Supervisory Committee audits, which are based on its auditing plans created for each fiscal year, are implemented with a focus on the legality and validity of the Directors' execution of duties, as well as the maintenance・operational status of internal control systems as priority items.

Furthermore, the Audit and Supervisory Committee exchanges information with the Internal Auditing Division and the Accounting Auditor as deemed necessary in order to enhance mutual cooperation.

f. Status of Accounting Audits

The Company has concluded an auditing contract with Ernst & Young ShinNihon LLC. In addition to receiving audits on periodic financial statements, etc., from Ernst & Young ShinNihon LLC, the Company has been examined for the maintenance・operational status of systems and procedures related to internal control, accounting systems and accounting records that are within the scope deemed necessary for auditing purposes, and moreover, have received reports on the results.

Basic Policy on Internal Control Systems

At the Board of Directors' Meeting, the Company has made resolutions that define the "Basic Policy on Internal Control Systems". The contents of the policy are as follows:

1. System to ensure that the execution of duties by the Group's Directors is in accordance with laws, ordinances and the Articles of Incorporation

(1) In order to carry out sound and sincere business activities with compliance as well as high moral values, the Company has established the "Nisso Group Charter of Corporate Behavior", and concrete guidelines for personal conduct, the "Nisso Group Employee Code of Conduct". In addition, the Directors have taken the initiative to implement these measures, and the Company shall continue to strive to ensure the thorough awareness of the measures by employees by posting them on the in-house intra-system.

(2) In order to ensure the thorough compliance of laws and ordinances, corporate ethics and internal regulations, the Company has established "Compliance Regulations", and has set up a "Risk Management Committee" chaired by a Director & Executive Officer to promote sound and sincere business activities.

(3) Directors who discover any material violation of laws or ordinances or any other material facts concerning compliance, shall report such matters to the Board of Directors.

(4) The Group has taken a resolute stance against unreasonable demands from anti-social forces, and has established concrete action guidelines which demonstrate that it has no relationships whatsoever with them. The Group shall continue to ensure the thorough awareness of such matters to Directors and employees in order to eliminate any relationships with these forces.

(5) In order to preserve corporate assets and improve management efficiency, the Company has established "Internal Audit Regulations", and has set up an independent Internal Auditing Division. The Group shall continue the auditing of its entire operations in regards to its compliance with laws and ordinances and the status of the execution of its business operations.

2. System concerning storage and control of information related to the execution of duties of Directors

(1) The Company has established "Document Control Regulations" for documents such as the minutes of the Board of Directors' Meetings and documents pertaining to other significant decisions as prescribed by laws and ordinances, in addition to properly storing and managing such documents after clarifying management responsibilities. Also, the Company shall continue to maintain a system which allows for the viewing of such documents as deemed necessary.

(2) The Company has established "Information Management Regulations" for confidential information, and shall continue to ensure security.

3. Regulations and other systems concerning the management of risk of loss

(1) The Company has established "Risk Management Regulations" for risks affecting business objectives (hereinafter referred to as "risks"), and in order to maintain a system that can adequately respond to such risks, it has set up a "Risk Management Committee" (hereinafter referred to as the "Committee"). The Committee shall convene in accordance with the regulations of the meeting body and shall be convened as deemed necessary.

(2) Based on the "Risk Management Regulations", the Committee identifies, analyzes and evaluates specific risks, and discusses its response policies. In addition, in the event where an emergency response is needed as the Committee monitors the status of risk management, an emergency committee shall be convened to discuss the necessary response measures.

(3) The Committee shall submit and report any matters related to risks to the Board of Directors on a regular basis or as deemed necessary.

(4) Each Division Head of the Group shall be responsible for risk management within their respective divisions, and must promptly report to the Committee Secretariat in the event that an emergency situation requiring reporting on risks arises, and in the event that there are risks involving multiple divisions, etc., or serious risks that may materialize. In addition, they are required to administer appropriate procedures, such as incorporating countermeasures in their business plans to respond to significant risks identified within their division of responsibility, as well as other individual risk-related matters.

(5) In order to respond promptly and accurately to the actualization of risks that may affect its business objectives, the Group has established response systems, procedures, and regulations in advance, and shall maintain and strive to improve the structure of reporting systems in the event of a crisis, as well as processes capable of responding quickly and appropriately.

(6) The Group shall formulate a business continuity plan and strive to develop a system that can promptly carry out business continuity after the occurrence of a disaster.

4. System to ensure the efficient execution of duties by Directors

(1) The Group has established "Regulations of the Board of Directors", and shall clarify the governance of the Board of Directors and matters to be discussed.

(2) To ensure the smooth and efficient operation of duties of Directors and employees, the Board of Directors has established "Organization・Division of Duties Regulations" and "Regulations of Administrative Authority", and shall determine matters regarding the segregation of duties of each division, as well as the fundamental roles, duties and authorities of each position.

5. System to ensure that the execution of duties by employees is in accordance with laws, ordinances and the Articles of Incorporation

(1) In order to carry out sound and sincere business activities with compliance as well as high moral values, the Company has established the "Nisso Group Charter of Corporate Behavior", and concrete guidelines for personal conduct, the "Nisso Group Employee Code of Conduct". In addition, the Directors have taken the initiative to implement these measures, and the Company shall continue to strive to ensure the thorough awareness of the measures by employees by posting them on the in-house intra-system.

(2) In order to ensure the thorough compliance of laws and ordinances, corporate ethics and internal regulations, the Company has established "Compliance Regulations", and has set up a "Risk Management Committee" chaired by a Director & Executive Officer to promote sound and sincere business activities.

(3) The Group has established "Whistleblower Protection Regulations", and shall institute a system for the early detection of violations of laws and regulations with regard to the Group, as well as ensuring that the informant is not subjected to any disadvantages.

(4) The Group has taken a resolute stance against unreasonable demands from anti-social forces, and has established concrete action guidelines which demonstrate that it has no relationships whatsoever with them. The Group shall continue to ensure the thorough awareness of such matters to Directors and employees in order to eliminate any relationships with these forces.

(5) In order to preserve corporate assets and improve management efficiency, the Company has established "Internal Audit Regulations", and has set up an independent Internal Auditing Office. The Group shall continue the auditing of its entire operations in regards to its compliance with laws and ordinances and the status of the execution of its business operations.

6. System to ensure appropriate business operations in the Corporate Group consisting of the Company and its subsidiaries

(1) In order to promote the fair business activities of the Group, the Company has established the Group-wide "Nisso Group Charter of Corporate Behavior", and concrete guidelines for personal conduct, the "Nisso Group Employee Code of Conduct". Furthermore, each company in the Group shall continue to strive to ensure the thorough awareness of these matters by Directors and employees.

(2) In order to strengthen the management of the Group, the Company has established "Affiliated Companies Management Regulations". In addition to requiring the reporting of significant matters concerning the business operations of subsidiaries, the Company shall refer matters of particular importance to the Board of Directors.

(3) The Company's Internal Auditing Division shall conduct audits of each company in the Group on a regular basis and when deemed necessary. Furthermore, the Internal Auditing Division shall cooperate with the Audit and Supervisory Committee and the Accounting Auditor to strive to ensure the proper business operations of the Group through audits.

7. Matters concerning Directors and employees who are to assist in the fulfillment of duties of the Audit and Supervisory Committee

(1) The Company shall immediately appoint employees to assist in the fulfillment of the duties of the Audit and Supervisory Committee when requested to do so.

8. Matters concerning the independency of employees in the preceding item from Directors (excluding Directors who are Audit & Supervisory Committee Members) and ensuring the effectiveness of instructions given by the Audit and Supervisory Committee to employees set forth in the preceding paragraph

(1) The Company shall have employees assisting in the fulfillment of the duties of the Audit and Supervisory Committee execute their duties under the direction of the Audit & Supervisory Committee Members whom they are assisting.

(2) The Company shall consult with the Audit and Supervisory Committee in advance about the decision of matters concerning personnel affairs of employees assisting in the fulfillment of the duties of the Audit and Supervisory Committee.

9. System for Directors (excluding Directors who are Audit & Supervisory Committee Members) and employees to submit reports to the Audit and Supervisory Committee and other systems related to submitting reports to the Audit and Supervisory Committee

(1) The Company shall request the attendance of Audit & Supervisory Committee Members for the "Board of Directors' Meetings", the "Risk Management Committee Meetings", and other meetings of importance.

(2) The Company's Representative Director and the Internal Auditing Division shall maintain cooperation with the Audit and Supervisory Committee and exchange information on a regular basis.

(3) Directors (excluding Directors who are Audit & Supervisory Committee Members) and employees of the Group shall respond to requests in the event they are asked by the Audit and Supervisory Committee to submit reports on important information.

(4) The Company shall ensure that persons who submit reports to the Audit and Supervisory Committee do not receive disadvantageous treatment due to reasons for submitting the report.

10. Other systems to ensure the effective implementation of audits by the Audit and Supervisory Committee

(1) Audit & Supervisory Committee members shall attend the "Board of Directors' Meetings", the "Risk Management Committee Meetings", and other meetings of importance.

(2) In response to the request of the Audit and Supervisory Committee, the Company shall establish a system that allows for the viewing of important documents such as minutes of meetings.

(3) The Company shall formulate a budget after confirming with the Audit and Supervisory Committee about the expenses required to perform its duties, in addition to establishing a system for the prepayment or reimbursement of expenses incurred when executing its duties.

Policy regarding System Development of Internal Control related to Financial Reporting

NISSO HOLDINGS Co., Ltd. (hereinafter referred to as the "Company"), in order to establish a system for ensuring the appropriateness of statements used for financial calculations and other information, have established a basic policy concerning the development of an internal control system related to financial reporting, as follows.

1. Control Environment

In order to appropriately conduct financial reporting, the Group shall establish and operate an environment necessary for control, such as the development of internal rules and regulations, the establishment of appropriate organizations, in addition to the securement and placement of appropriate human resources.

2. Risk Assessment and Response

- The Group shall identify risks that impede the appropriateness of financial reporting, and implement the assessment and response of significant risks.

- With regards to risk assessment, the Group shall analyze the degree of influence and the probability of occurrence, etc., of risks depending on their nature, and evaluate them appropriately.

- The Group shall take necessary measures such as reduction, possession, avoidance, removal, etc., of risks that have been assessed.

- The Group shall conduct risk assessment and response on a continuous basis every period.

3. Control Activities

- In order to ensure the appropriateness of financial reporting, the Group shall establish regulations and operational manuals, etc., for organization and duties, and clarify the division of duties, authority and responsibilities.

- Based on the implementation status of internal control, the Group shall establish and operate a system that is able to make necessary enhancements of problematic matters.

4. Information and Communication

In order to ensure the appropriateness of financial reporting, the Group shall establish and operate a system in which information pertaining to internal control is communicated in a timely and accurate manner to those in need of such information.

5. Monitoring

In order to continuously evaluate that internal controls are functioning effectively (or “In order to continuously evaluate the effectiveness of internal control functions”), the Group shall establish a system for routine monitoring and independent evaluations.

In addition, the Group shall establish and operate a system to rectify problems or deficiencies related to control in a timely and appropriate manner.

6. Response to IT

- The Group shall effectively and efficiently utilize IT to ensure the effectiveness of the control environment, risk assessment and response, control activities, information and communication and monitoring.

- In order to effectively and efficiently utilize IT, the Group shall have an appropriate understanding of the IT environment and the scope of control using IT, in addition to establishing and implementing appropriate policies and plans related to such matters.